Blending families requires three things: love, patience and lots of flexibility!

Blending families requires three things: love, patience and lots of flexibility!

Merging two households of habits, DNA, traditions and temperaments, let alone finances as well, is a recipe for…well, the authors of the book I’m reviewing here call it a minefield! As someone who is currently going through, I can say that I agree. It’s not a challenge we raise our hand and actively seek out, but many of us that are entering blended families from loss or divorce have to adapt to this situation; there are some best practices we can implement.

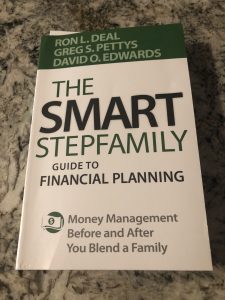

I turned to local Springfield dad and estate planning and elder law attorney David Edwards for some guidance. He recently partnered with two others to write: The SMART stepfamily guide to financial planning which I found to be a very practical guide that helps you sort through the emotional and financial risks at hand. Their goal is to help us make financial conversations and decisions an asset in our lives, not a liability.

The author team covers every topic under the blended family scope from the opening question of “what are you debts and assets” to merging yours, mine and ours, parenting adult children, caring for adult parents, and planning your child’s education and your retirement!

My favorite chapter was “Stay calm and stay the course.” There is no “easy” solution! Financial planning conversations can be awkward and uncomfortable. It’s important to be open and transparent about your goals and concerns so you can work them out! Take breaks and don’t tackle each item at once, make a list and chip into it gradually, and seek professional advice when needed. Peace of mind is worth that investment. Whether you’re in the process of dating or already an integrated step-family, I recommend this book goes into your holiday stocking this year, so you can kick off the New Year informed and ready to tackle any open issues at hand.

Pictured Below: The SMART Stepfamily Authors, Springfield Dad, David Edwards is on the far right.